Motorola Solutions, Inc. (NYSE: MSI) today reported its earnings results for the third quarter of 2023.

“Q3 was another strong quarter, with record third-quarter revenue, earnings and cash flow,” said Greg Brown, chairman and CEO of Motorola Solutions. “Safety and security have never been more important and we continue to see robust demand which drove our record Q3 backlog. As a result, we’re again raising our revenue and earnings expectations for the full year.”

OTHER SELECTED FINANCIAL RESULTS

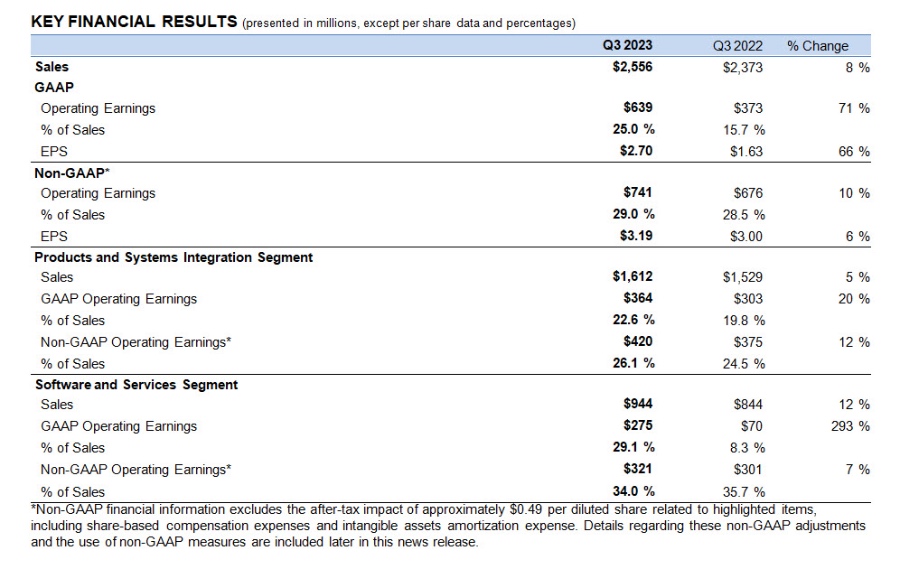

Revenue - Sales were $2.6 billion, up 8% from the year-ago quarter driven by growth in North America and International. Revenue from acquisitions was $19 million and currency tailwinds were $13 million in the quarter. The Products and Systems Integration segment grew 5%, driven by growth in land mobile radio communications ("LMR") and video security and access control ("Video"). The Software and Services segment grew 12%, driven by growth in command center, LMR and Video, partially offset by the revenue deferral for Airwave attributed to the pricing control in the remedies order as previously noted.

Operating margin - GAAP operating margin was 25.0% of sales, up from 15.7% in the year-ago quarter primarily due to the $147 million fixed asset impairment charge related to the exit from the Emergency Services Network ("ESN") contract in the U.K. recorded in the prior year. Non-GAAP operating margin was 29.0% of sales, up 50 basis points from 28.5% in the year-ago quarter, driven by higher sales, lower material costs and improved operating leverage, partially offset by the revenue deferral for Airwave and mix in the Products and System Integration segment.

Taxes - The GAAP effective tax rate was 21.5%, up from 15.9% in the year-ago quarter. The non-GAAP effective tax rate was 22.7%, up from 19.7% in the year-ago quarter. The increase in both the GAAP and non-GAAP tax rate was primarily driven by lower benefits from stock-based compensation recognized in the current year.

Cash flow - Operating cash flow was $714 million, compared to $388 million in the year-ago quarter and free cash flow was $649 million compared to $318 million in the year-ago quarter. Both the operating cash flow and free cash flow for the quarter increased primarily due to higher earnings, net of non-cash charges, and improved working capital.

Capital allocation - During the quarter, the company repurchased $322 million of shares, paid $147 million in cash dividends, and incurred $65 million of capital expenditures.

Backlog - The company ended the quarter with record Q3 backlog of $14.3 billion, up 6% or $764 million from the year-ago quarter, inclusive of $321 million of favorable currency rates. Products and Systems Integration segment backlog was up $62 million, or 1%, driven by continued strong demand in North America. Software and Services segment backlog was up $702 million, or 8%, inclusive of $294 million of favorable currency rates, driven by increases in multi-year software and services contracts in North America, partially offset by revenue recognition for the Airwave contract.

NOTABLE WINS AND ACHIEVEMENTS

Software and Services

$23M LMR service agreement for a large European customer

$23M LMR service agreement for East Bay Regional Communication Systems

$20M LMR service agreement for the Los Angeles Police Department

$12M command center order for Tarrant County 9-1-1 District, TX

$8M body-worn camera order for the Metro Nashville Police Department

Products and Systems Integration

$75M P25 device order for a U.S. federal customer

$55M P25 system order for a Southeast Asia customer

$42M P25 device order for the Texas Department of Public Safety

$30M P25 device order for a U.S. federal customer

$20M P25 device order for Indiana State Police

$3M fixed video expansion order for a U.S. federal customer

BUSINESS OUTLOOK

Fourth quarter 2023 - The company expects revenue growth of approximately 4%, compared to the fourth quarter of 2022. The company expects non-GAAP EPS in the range of $3.60 to $3.65 per share. This assumes approximately 171 million fully diluted shares and a non-GAAP effective tax rate of approximately 24%.

Full-year 2023 - The company now expects revenue in the range of $9.930 billion to $9.945 billion, up from its prior guidance of $9.875 billion to $9.900 billion, and non-GAAP EPS of between $11.65 and $11.70 per share, up from its prior guidance of between $11.40 and $11.48 per share. This outlook assumes approximately $40 million in foreign exchange headwinds, approximately 172 million fully diluted shares and a non-GAAP effective tax rate of approximately 23%.

The company has not quantitatively reconciled its guidance for forward-looking non-GAAP metrics to their most comparable GAAP measures because the company does not provide specific guidance for the various reconciling items as certain items that impact these measures have not occurred, are out of the company’s control, or cannot be reasonably predicted. Accordingly, a reconciliation to the most comparable GAAP financial metric is not available without unreasonable effort. Please note that the unavailable reconciling items could significantly impact the company’s results.

RECENT EVENTS

CMA UPDATE

In October 2021, the United Kingdom’s Competition and Markets Authority (the "CMA") announced that it had opened a market investigation into the Mobile Radio Network Services market. This investigation included Airwave, the company's private mobile radio communications network that it acquired in 2016. Airwave provides mission-critical voice and data communications to emergency services and other agencies in Great Britain.

On April 5, 2023, the CMA issued its final decision which stated it will impose a prospective price control on Airwave. The company strongly disagrees with the CMA’s final decision and it filed an appeal with the Competition Appeal Tribunal (“CAT”) on June 5, 2023. On July 31, 2023, the CMA adopted a remedies order which implements the price control set out in its final decision; however, the remedies order has been suspended until the CAT’s judgment on the company’s appeal. The CAT appeal hearing took place on August 2 and 3, 2023. Depending on the outcome, further appeals may occur throughout 2023 and 2024.

Based on the adoption of the remedies order, since August 1, 2023, revenue under the Airwave contract has been deferred and recognized in accordance with the prospective price control, which will continue until a successful appeal. The company estimates a year-over-year reduction in Airwave revenue of approximately $80 million in 2023, driven by the deferral of revenue, offset by incremental ongoing services and favorable foreign exchange rates. Meanwhile, the company's backlog continues to remain at original contract terms until new pricing is final. The company has tested its Airwave asset group for impairment, noting the assets are expected to be recoverable.

MACROECONOMIC EVENTS

Since the beginning of the COVID-19 pandemic, the company has navigated disruptions in its supply chain, in particular challenges in procuring certain semiconductor components along with diminished transportation capacity and higher freight costs. During the first nine months of 2023, the company has experienced gradual improvement in the market conditions influenced by the effects of the COVID-19 pandemic and the inflationary cost environment, particularly with respect to availability of materials in the semiconductor market. Where appropriate, the company has taken pricing actions around its product and service offerings to mitigate its exposure to inflationary pressures and have benefited from these adjustments during the first nine months of 2023. The company expects to continue to benefit from such adjustments in the last quarter of 2023. The company remains focused on improving its supplier network, engineering alternative designs and working to reduce supply shortages and effectively manage costs. In addition, the company continues to actively manage its inventory in an effort to enable continuity of supply and services to its customers, which includes diversifying the footprint of its supply chain operations. The company expects to maintain elevated levels of inventory until supply conditions stabilize.